Continuing our series on the SC angel tax credit, this post updates our data on the use of the credit. This is publicly available information, but I don’t think it is summarized in one place, so we hope it is useful.

Qualified Businesses

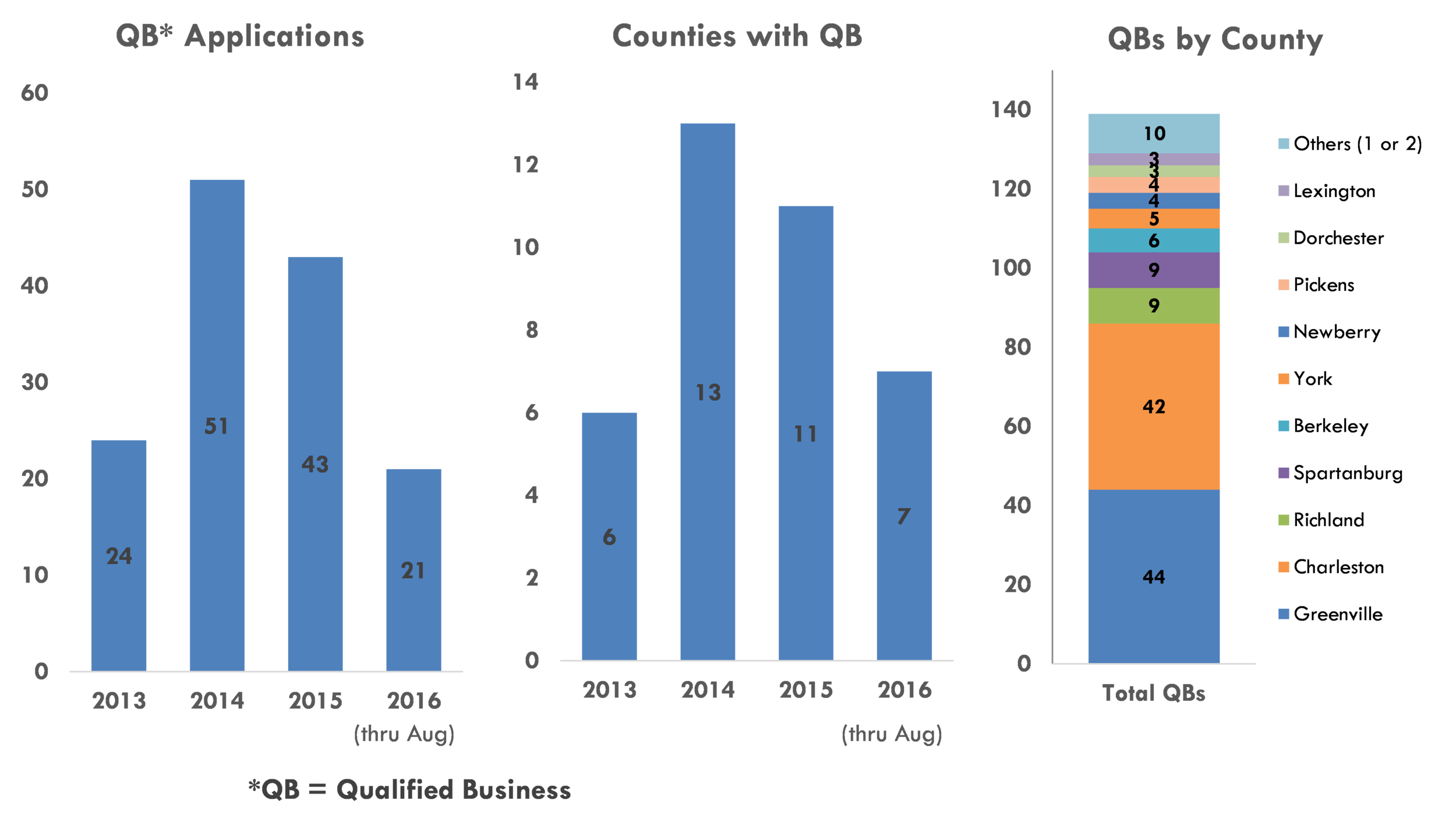

The chart below updates our slides from last year on how many businesses have applied to become eligible for the credit. After a strong start, the number of companies applying to be qualified (as QBs – Qualified Businesses) fell a little in 2015 and 2016 (with data below shown through August).

Why? Our guess is that 2014 saw the “backlog” of applications from companies that wanted to become qualified but couldn’t because the credit was not yet available. Around forty companies (the 2015 and estimated full year 2016 levels) is probably at the “mature” amount that we’ll see now this backlog has passed.

Interesting to see that “Silicon Harbor” has fewer qualifying businesses than Greenville County so far. Wonder if Lowcountry Angels can help change that?

Credit Awarded

The credit is definitely being claimed. In 2015, the full $5 million of credits were issued for the first time, a 75% increase over the $2.9 million awarded in 2014. Over 150 investors applied to get the credit (up 64% over 2014), and most were successful (141, or 90% of the applicants – the highest so far as people fully understand the rules).

In fact, a total of $15.4 million of qualified investments were made: the final credit was 32.4% (rather than 35%) as all applicants were pro-rated down, meaning over $15 million was applied.

Based on our investment activity so far this year, we suspect the full $5 million will again be used in 2016 – with VentureSouth companies like Crowdr, ActivEd, and TipHive joining other SC companies in successful fundraising efforts.

We thought it interesting to see that the vast majority (90%) of investor applicants were from South Carolina. (A portion of the 10% “out of state” were members of our Asheville Angels group.) This demonstrates that there is capital here to invest in early stage companies. But it is also good to see that SC companies can attract out-of-state investors to invest here.

There is no publicly available data on what proportion of the awarded tax credits were actually used.

Takeaways:

Entrepreneurs: apply to be a qualified business before you try to raise capital. It’ll show you’ve done your homework.

Investors: make sure the business you plan to invest in is qualified BEFORE YOU INVEST!